Get In Touch

Questions? Please fill this form and our team will get in touch.

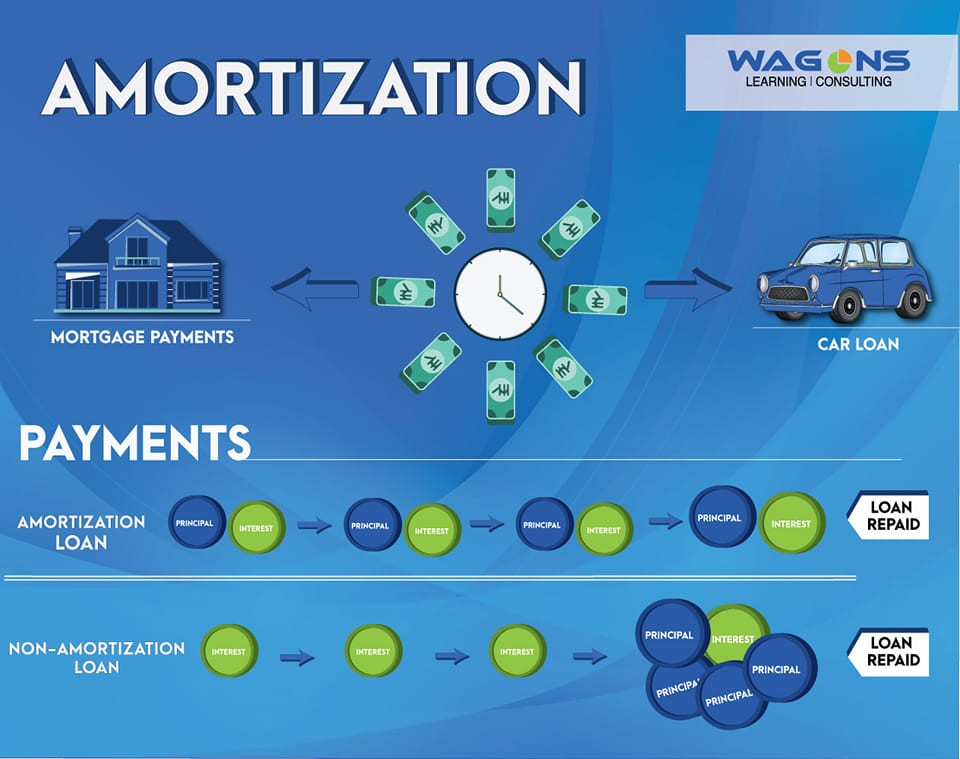

Amortization is a way of paying off a debt by spreading payments

over a period of time that are applied to both the loan's

principal amount and the interest accrued. We can determine the

amount of loan payments once we know the frequency of payments,

the interest rate, and the tenure. An amortized loan payment

first pays off the relevant interest expense for the period,

after which the remainder of the payment is put toward reducing

the principal amount.

Learn how to build an amortization dashboard with financial and

conditional formulas with Wagons Training Program. In this

course, we'll be looking at the key financial formulas that can

be used to investigate loans, like student loans, car loans, and

mortgages.

Click on the link below to register 👇

https://wagonseducation.com/

Your email address will not be published. Required fields are marked *