Get In Touch

Questions? Please fill this form and our team will get in touch.

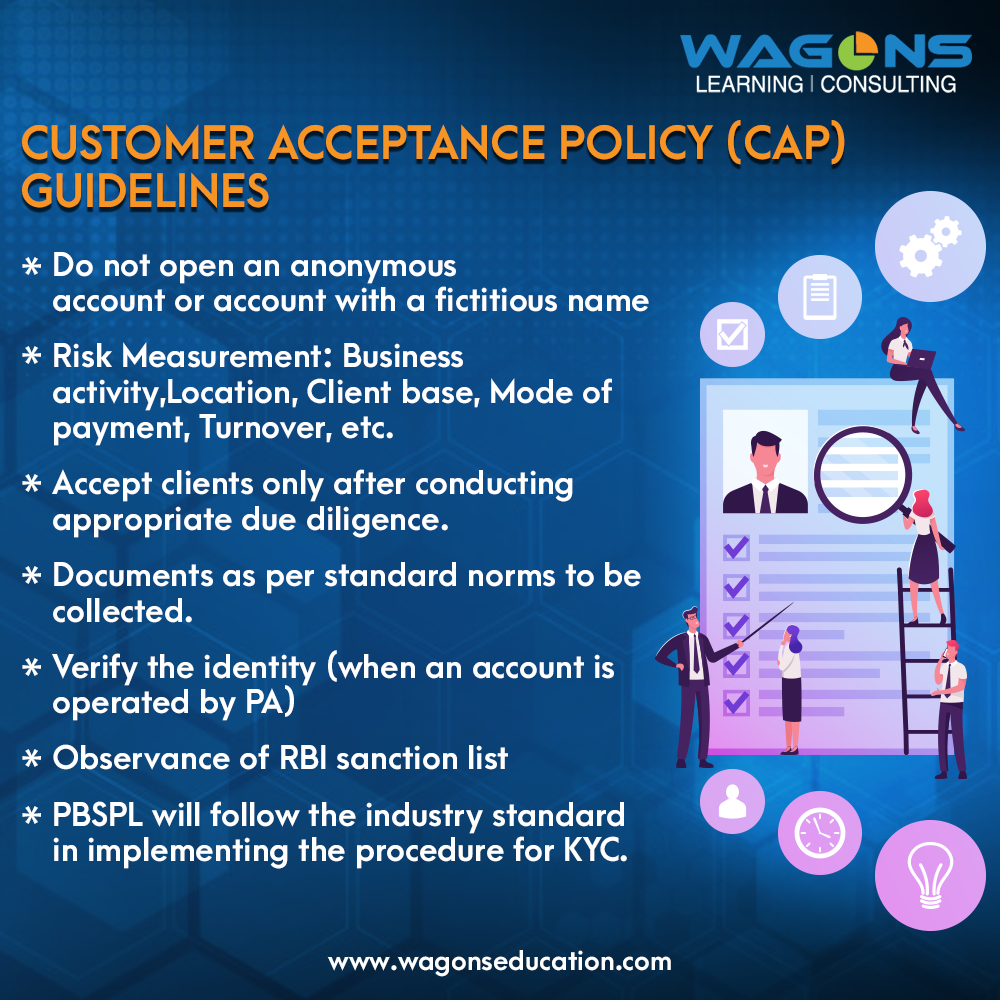

The Customer Acceptance Policy (CAP) of the Bank is a

significant document in determining the basis on which the Bank

enters into relationships with its customers. An inadequate CAP

or the deficient execution of the CAP can expose the Bank to

serious compliance, legal, financial and reputational risks.

Banks acknowledge only those customers whose identity is

established by conducting due diligence appropriate to the risk

profile of the customer. Gathering adequate and relevant

information about the client before the relationship is

established is the 1st effective step toward defense against the

Bank being utilized as the medium to launder the proceeds of

crime or to finance terrorism.

For more information visit:

https://www.wagonseducation.com/

Your email address will not be published. Required fields are marked *